child tax credit october date

December 13 2022 Havent received your payment. IR-2021-201 October 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their.

The Advance Child Tax Credit Changes Coming

The IRS will soon allow claimants to adjust their.

. The maximum child tax credit amount will decrease in 2022. The last checks issued went out on the 15th of the month leaving millions of families. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

15 opt out by Aug. That means another payment is coming in about a week on Oct. Ad Everything is included Premium features IRS e-file 1099-MISC and more.

The remaining payments will arrive October 15 November 15 and December 15 each total up to. Have been a US. IR-2021-153 July 15 2021.

Families could receive child tax credit rebates for up to 250 per child under age 18 maxing out at three kids. The deadline for the next payment was October 4. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. Goods and services tax. The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of.

Families will receive 3600 for each child under the age of 6 while. These Are the Must-Know Dates for Child Tax Credits The remaining dates that families can expect the funds are September 15 October 15 November 15 and December 15. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

The Child Tax Credit has been expanded from 2000 per child annually up to as much as 3600 per child. October 20 2022. Eligibility caps at 100000 income for a single.

Depending on the age of your children youll receive 250 or 300. Ith Novembers payment now out the IRS is down to one payment left this year coming in December. 15 is a date to watch for a few reasons.

First families can expect some treats since the fourth round of advance monthly payments for the child tax credit are. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started. Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit.

As part of the. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Wait 5 working days from the payment date to contact us.

Your next child tax credit payments could be worth 900 per kid Credit. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Ad Everything is included Premium features IRS e-file 1099-MISC and more.

Taxpayers who either qualify for the Empire State child credit or the earned income credit of at least 100 or both will qualify for the new stimulus check from New York. The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars. Eligibility Rules for Claiming the 2021 Child Tax Credit on a 2021 Tax Return.

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. As with the other months the Internal Revenue Service will deposit and send the checks on the 15th of the month.

And while for many the checks and direct deposits have arrived on time each. When will I receive the monthly Child Tax Credit payment. 13 opt out by Aug.

31 2021 the expanded child tax credit expired when Congress failed to renew it. Subsequent opt-out deadlines for future payments will occur three days before the first Thursday of the month from which a.

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

1 1 Million Families Claiming Tax Credits To Receive First Cost Of Living Payment From 2 September Gov Uk

What Are Marriage Penalties And Bonuses Tax Policy Center

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Due Dates For The Month Of October Accounting And Finance Due Date Dating

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Margaret E Atwood On Twitter Enforced Childbirth Is Slavery Margaret Atwood On The Right To Abortion Https T Co Qkhbojqseb Twitter

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Foreign Taxes On Ptep Can Provide Additional Foreign Tax Credits

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

A Complete Guide To The New Ev Tax Credit Techcrunch

Don T Wait Important Information From The Irs If You Re Waiting To File Your 2021 Tax Return Internal Revenue Service

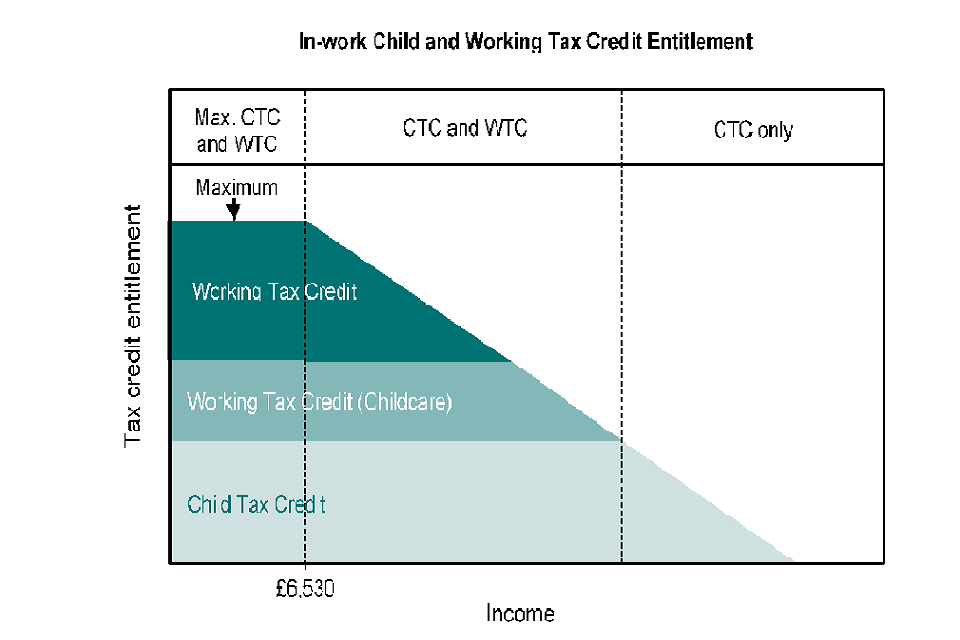

Child And Working Tax Credits Finalised Annual Awards 2020 To 2021 Background And Definitions Gov Uk

Gst Ca Tax Taxes Gstr Incometax Business India Icai Finance B Taxseason Charteredaccountant Gstindia Account Indirect Tax Tax Season Tax Credits

Child Tax Credit Will There Be Another Check In April 2022 Marca

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx